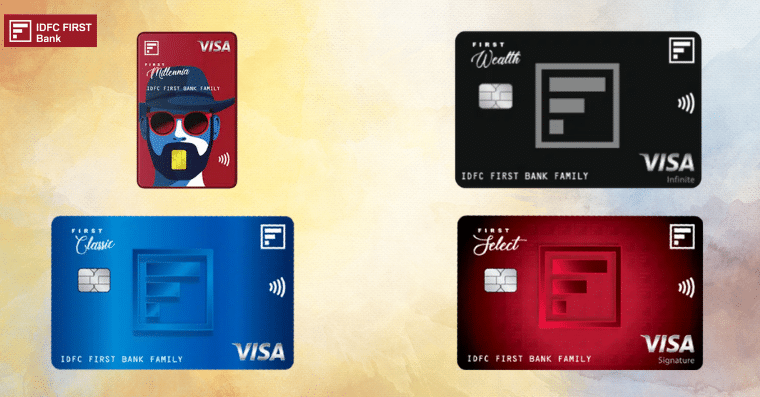

IDFC First Bank from 2015 has grown a lot. It has expanded its banking operations and now it issues 4 credit cards in total to its customers. This is the first bank that offers all the credit cards at no membership fee cost at all. All 4 credit cards namely IDFC First Wealth credit card, IDFC First Select credit card, IDFC First Classic credit card, and IDFC First Millennia credit card are packed with highly rewarding rewards programs, features & benefits. Here are the common features and benefits that you will get to enjoy with an IDFC First credit card and the reasons why you should get an IDFC First credit card.

- Fees: IDFC First Bank offers all its credit cards at zero charges. They are lifetime free credit cards and to get them you need to have a good credit score. The applicant must be above the age of 21 years, must have a minimum annual income of 3 years, and shall be a resident of India.

- Finance Charges: To make the experience of credit cardholders more worthwhile, the bank has kept a low finance charge between 0.75% – 2.99% p.m. on all of its 4 credit cards. The finance charges will be decided on the basis of your income level.

- Foreign Markup fee: Those who have international expenses can go for the IDFC First Select credit card & IDFC First Wealth credit card as both these credit cards have low foreign markup fees as compared to the other two credit cards and can save money on the international transactions.

- Welcome Benefits: On IDFC First Bank credit cards you get to enjoy the signup benefits. Under the welcome benefits, you get gift vouchers, cash back’s, bonus reward points, etc. on using the credit card within the specified time period. These benefits differ from credit card to credit card.

- Reward rate: On all the credit cards of IDFC First Bank entitles you to the same rewards program. You get to earn 1 reward point on every Rs. 100 spent using the card and then on the selected transactions you get to earn accelerated reward points. You can never be disappointed with the IDFC First credit card rewards program.

- Reward redemption: You can redeem your accumulated reward points for purchasing products from the product catalog, buying gift vouchers, booking flights/hotels, etc. The credit cardholders get access to the Poshvine Reward portal where all the exclusive partner stores are listed such as Amazon, Flipkart, Myntra, etc. which you can use to redeem the reward points. There is no redemption fee for redeeming the reward points. 1 reward point is equivalent to Rs. 0.25 for redemption on all IDFC First Bank credit cards.

- Travel Benefits: All 4 credit cards have complimentary lounge access. IDFC First Select Credit Card and IDFC First Wealth Credit Card entitle you to complimentary domestic and international lounge access whereas IDFC First Classic Credit Card and IDFC First Millennia Credit Card only provide complimentary domestic lounge access. You can choose a credit card depending on your travel needs.

- Other Benefits: Under other benefits, you get insurance benefits, movie and dining benefits, free add-on credit cards, and a fuel surcharge waiver on the IDFC First credit cards.

Bottom Line:

To conclude, you must go for an IDFC First credit card as you will get to enjoy a lifetime rewarding experience with it. Being lifetime free credit cards they provide a lot of features and benefits to their customers. Identify your needs and spending habits first and then apply for a credit card that matches them.